Amazon's $2 Billion Climate Pledge VC Fund

For a long time running now, Amazon.com has consistently received negative attention from the media on controversial actions or aspects of the business (suppressing unions, not paying workers enough, and their environmental impact, to name a few). However, Amazon is taking huge steps to address one of its largest pain points to society: its environmental impact.

In 2019, Amazon co-founded (with Verizon, Reckitt Benckiser Group, and Infosys) the “Climate Pledge,” a commitment to reach carbon-reduction goals set in the Paris Climate Agreement and be carbon-neutral by 2040 (a decade earlier than the widely accepted deadline before irreversible damage and catastrophic environmental change ensues). Amazon’s stated annual emissions at the time the agreement was signed exceeded 50 million metric tons of carbon dioxide, meaning that the company was a long way from meeting its goal. In signing this pledge, Amazon also agreed to a number of other ambitious goals, including purchasing 100,000 electric delivery vehicles, investing $100 million in reforestation projects, using 100% renewable energy by 2025, and making 50% of all shipments net zero carbon by 2030 (and eventually, make all shipments net zero).

This was at least partially in response to thousands of Amazon employees (through a group called Amazon Employees for Climate Justice) sending the company a letter asking it to take stronger action to combat climate change.

Two days after signing the Climate Pledge in September of 2019, the company also revealed that it had acquired the naming rights to an NHL arena in the company’s hometown of Seattle. The company later dubbed the building the “Climate Pledge Arena.”

In January of 2020, 350 Amazon staff members protested Amazon’s implementation of a policy stating that employees who publicly criticize the company’s stance on climate change will face punishment or termination. This caused many to doubt the sincerity of Amazon’s commitment to curb its negative environmental impact and further illustrated poor treatment of employees.

One year after the signing of the Climate Pledge, Amazon announced that it was starting a $2 billion venture capital fund, called the Climate Pledge Fund, to finance companies that could directly assist Amazon in meeting its goal of going carbon neutral by 2040 (among its many other commitments) and to make substantial returns in the process. Around this time, Amazon also announced that it acquired Zoox, a VC-backed maker of electric self-driving cars, for about $1.2 billion. Matt Peterson, Director of Corporate Development New Initiatives at Amazon, told Axios Amazon is trying to publicize their efforts as much as possible, "to build accountability for us … Those naming rights [on that stadium] go for a long time and basically if people look back in 5 to 10 years and say, 'Amazon hasn't done anything since putting their name on the stadium,' that's on us … It’s a forcing function for us to make that sure that … we are focused on this issue."

The Climate Pledge Fund’s $2 billion amount has repeatedly been described as merely “initial funding” that could grow over time. All of the $2 billion managed by the Climate Pledge Fund comes directly from Amazon’s balance sheet, meaning that Amazon has full autonomy in determining the fund’s timeline and faces no pressure to deliver returns to limited partners. That said, the goal of the fund is not charity, and Amazon fully intends, on its own terms, to make returns on par with the venture capital industry.

The fund appears to be flexible in the context of its investments, as Jeff Bezos explains: “Companies from around the world of all sizes and stages will be considered, from pre-product startups to well-established enterprises … Each prospective investment will be judged on its potential to accelerate the path to zero carbon and help protect the planet for future generations.” The fund’s investment amounts already range from hundreds of thousands to hundreds of millions of dollars, illustrating this flexibility being put into practice.

The Climate Pledge Fund has the benefit of organic demand-side deal sourcing, in that the fund is primarily investing in companies that Amazon itself will be a customer for. As such, each portfolio company’s ability to meet a need in the market is validated by Amazon itself needing the company’s product or service. Amazon simultaneously acting as an investor and a customer to its portfolio companies gives them a significant advantage in having access to Amazon’s abundant resources from multiple channels.

The Climate Pledge Fund invests across a range of industries including, but not limited to, transportation and logistics; circular economy; manufacturing and materials; energy generation, storage, and utilization; and food and agriculture. The fund’s flexible philosophy allows Amazon to invest to best meet the company’s unique needs.

Overview of the Climate Pledge Fund’s Portfolio Companies

Turntide Technologies creates an electric motor designed to reduce electricity consumption and accelerate the transition away from using fossil fuels. The company’s system leverages reluctance motor technology and is connected to precise controls via IoT, enabling customers to save on energy costs from a number of avenues, including refrigeration, maintenance, and space conditioning. Its most recent financing round included other CleanTech specialized investors such as Breakthrough Energy Ventures, Captain Planet, Fifth Wall, and the FootPrint Coalition.

Infinium produces electrofuels intended to decarbonize transportation without infrastructure modifications. These fuels act as “drop-in” replacements for traditionally petroleum-derived products. Infinium’s electrofuel mix currently includes jet fuel, marine fuel, and diesel, with automobile-grade gasoline and train fuel in the works. In addition to Amazon’s fund, the company has also received investment from expert engineering and electrical equipment firm Mitsubishi Heavy Industries, validating the effectiveness of its novel technology.

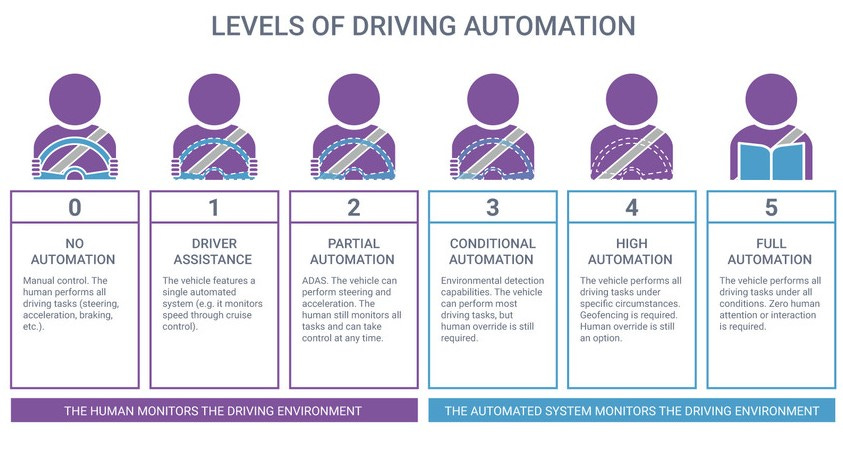

Rivian offers adventurous completely electric vehicles (currently offers a truck and an SUV model). The company’s vehicles come with high power motors, durable 180 KWh batteries, and level 3 autonomy (levels of autonomy described in Figure 1 below). Its vehicles also have drive units, battery pack, suspension system, brakes and a cooling system all below wheel height, allowing for more storage space and greater stability. This company has received hundreds of millions in investment capital from the Climate Pledge Fund, raising a total of over $5 billion in the last year and a half alone.

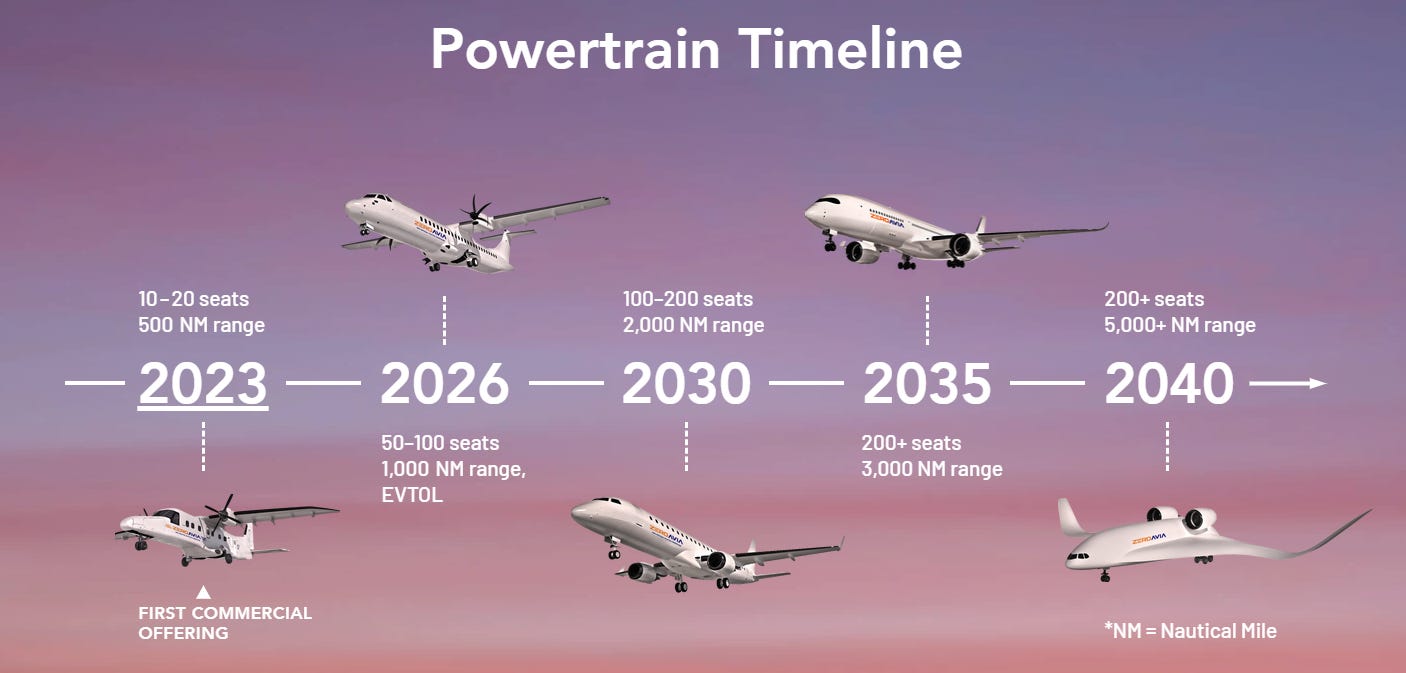

Figure 1 (Source: Synopsys) ZeroAvia has developed a zero-emissions powertrain — the system of components that converts an engine’s power into movement — designed for use in commercial air travel. ZeroAvia uses hydrogen fuel-cells to power aviation, and with the implementation of its system, fuel and maintenance costs are reduced by as much as 75%, resulting in a total trip cost reduction of up to 50%. While its technology currently only works for commercial planes with 10-20 seats, at a trip distance of 300-500 miles, the company’s product development timeline projects a steady ramp-up of technological capabilities (shown below on Figure 2).

Figure 2 (Source: ZeroAvia) Redwood Materials is a circular economy startup that recycles discarded cell phone and device batteries into EV batteries, doubly solving environmental challenges. Redwood Materials also converts used batteries into batteries applicable to storing renewable energy from the grid. This, the company claims, may turn out to be a far larger market than the EV market. The company also works with manufacturing companies that wish to recycle battery components from end-of-life products and implement reverse logistics to decrease sourcing and manufacturing costs while also reducing their environmental impact. When the recycling of batteries or consumer electronics is impossible, Redwood Materials expertly salvages expensive materials like gold and palladium from these discarded products to turn waste liabilities into revenue streams for production companies.

Pachama: The truth is that carbon emissions reductions are not enough to stop the progression of climate change; carbon dioxide must be removed from the atmosphere in order to reverse the damage that has already been done, and planting trees is the easiest, most cost-effective way of removing carbon dioxide from the atmosphere. However, reforestation efforts are often underfunded and underprioritized, due to a lack of reliable data backing the carbon reductions accomplished from reforestation. Pachama has addressed this problem by developing an AI and remote sensing platform intended to verify and monitor carbon capture by forests to help finance conservation and reforestation. The company's platform combines machine learning, satellite imaging, drones, and lidar (Light Detection and Ranging) technologies to scale up the protection and restoration of the forests. Clients seeking to track atmospheric carbon reduction as a direct result of their financing of reforestation efforts (like Amazon) can use Pachama’s technology to do so. This technology may be the key to selling reforestation as an important component of meeting companies’ net carbon neutral goals.

CarbonCure has developed retrofit technology that chemically sequesters waste carbon dioxide during the concrete manufacturing process to make greener and stronger concrete. The company’s technology introduces recycled carbon dioxide into fresh concrete to reduce its carbon footprint without compromising performance. Once injected, the carbon dioxide undergoes a mineralization process and becomes permanently embedded. This drives climate benefits for concrete producers, as well as economic benefits, facilitated by CarbonCure’s cost reductions with no upfront capital requirement.

With Amazon’s Climate Pledge Fund promising to become a leader in CleanTech investment, the success of this vertical is paramount to the success of the fund. Many venture investors are weary of CleanTech, because about 10 years ago, an enthusiasm for CleanTech resembling today’s lost VCs a lot of money. According to PitchBook data, from 2006 to 2008, the number of VC investments in the US CleanTech sector increased by 137%, with deal value more than tripling. Despite immense support from investors the CleanTech sector declined due to a number of factors, including the 2008 financial crisis, a decrease in the price of natural gas making it a more attractive substitute, and the influx of government-subsidized solar panel companies from China that outcompeted US solar companies.

Between 2011 and 2017, CleanTech venture deal amount decreased by 44%, despite increasing awareness of the risks posed by climate change. This reflects the dramatic drop in investor confidence in the sector post-financial crisis.

However, there is evidence of a CleanTech rebound. According to PitchBook data, in 2020 VC investment in CleanTech was $19.86 billion, an almost 25% year-over-year increase (Figure 3 shows a breakdown of all capital invested in CleanTech across the sector’s existence, by industry). 2020 also saw almost $10 billion raised by IPOs in the space — a record high. With the Biden administration’s clear commitment to the goal of net zero emissions by 2050, CleanTech companies are experiencing unprecedented demand. It appears as though the long-anticipated returns in the CleanTech sector may soon be realized, suggesting that the CleanTech investment leader that is Amazon’s Climate Pledge Fund may not only help achieve carbon neutrality, but it may also achieve outsized returns.