From Barter to Bitcoin

How Blockchain Technology Fixes Our Imperfect Monetary Systems

What is money? This question, as simple as it seems, has been reworked and revised throughout human history to create more efficient economies and methods of exchange. Money must function as a store of value. An individual’s retirement savings need to be worth something 20 years after the money was made. Money must function as a medium of exchange. A customer in a store must be able to pay for their goods somehow. Finally, money must be trustworthy. People need to trust that they can buy goods with the money in their pocket.

As simple as it might seem to create a perfect form of money, humans have been struggling with this task since the beginning of time.

We are in an age of a new monetary system, the first to ever be engineered to perfection. The creation of Bitcoin, or the Bitcoin blockchain, will revolutionize the way the world views money, and the institutions surrounding it. Bitcoin recognizes the failures of past systems and works to create a perfect and sound form of money that acts as a storage of value, a medium of exchange, and eliminates the need for trust in third parties. This article outlines four of the major monetary systems of the world, why they have failed, and how the Bitcoin technology has improved on these weaknesses.

Monetary Systems Throughout the Ages

The Bartering System

In the most basic form of economic transaction, humans began trade through a bartering system. Bartering economies utilize trade of objects or resources in exchange for other objects and resources. A farmer might trade their crops for clothes from a tailor, shoes from a shoemaker, or cattle from a cattle herder. In these economies, two individuals agree to a transaction because they both have something the other wants and deems equal in value to their resources. Bartering systems have worked for thousands of years and still exist today mostly in underdeveloped areas. While it is easy for two individuals to trade resources with no third party involved, there are large issues with the barter system for growing economies.

Problems with the Bartering System

The first issue with the bartering system comes when two parties cannot agree on an equitable trade. Say a farmer wants to trade four bushels of wheat for one cow, but the cow farmer wants five bushels for his cow. What happens then? When two parties cannot agree to a trade they both see as beneficial for themselves, no trade can occur at all.

The second issue is the limit on economic growth that the barter system imposes. Bartering works well in a small, local economy. However, as civilizations began to grow, it was highly inefficient to transact through bartering. The same farmer who wanted to trade four bushels of wheat for a cow, now has offers to receive shoes, clothes, horses, books, candles, and hundreds of other items in exchange for his wheat. The farmer can either accept these trades and have hundreds of objects he does not want or need, or abstain from selling his wheat, putting his farm out of business. There is less incentive for the farmer to contribute to the economy by selling wheat when he cannot get the things he wants and needs in return. On a large scale, barter economies carry immense inefficiencies with them, limiting growth of an economy. Physical resources could not succeed as money, as they failed to offer a universal medium of exchange.

Minted Coins

To improve on the bartering system, currency was invented. Now, instead of trading a cow for a bushel of wheat, people could trade a coin for wheat. The advantage to this is that because a coin could be used to buy any item, it has value to the second party in the trade. Empires around the world adopted the use of coins, often made of precious metals like gold and silver. A monetary system that uses only one type of precious metal in their coins is known as monometallism, though most countries opted for a bimetallist system, where there were multiple types of coins (gold, silver, copper), so as to not exhaust the resources of one type of metal, and to increase stability in the currency by increasing its market cap. More metal means more coins. This system made for more efficient transactions by removing the need for a trade of physical resources, provided a more stable storage of value than livestock or crops, and was easier to transport than physical resources.

Problems with Minted Coins

The minted coin monetary system had a few fatal flaws, that eventually led to its replacement. The first issue was the potential for currency arbitrage.

The regulating body who minted the coins set an exchange rate between the two types. For an example, imagine that England makes gold coins and silver coins. England might say that 1 gold coin is equivalent to 20 silver coins. However, the market prices of the metals from which the coins are made deviate from this fixed exchange rate. Individuals would opt to move all their savings into the undervalued metal, as they knew over time, they would make up the difference between the fixed price and the market price. The graph below shows the silver to gold ratio in the United Kingdom since 1300. With such volatile movement in the supply ratios of these two metals, this arbitrage method would be very profitable. Minted coins failed as currency because they did not serve as a stable storage of value.

Gold-Backed Paper Notes

When minted coins failed due to exchange rate arbitrage, many civilizations moved to a gold-backed paper money system. Governments declared that every dollar printed was backed by a dollar of gold kept in reserves, hence protecting the value of a dollar, while removing the inconvenience of carrying physical gold. The gold standard in America lasted from 1879 to 1933, and with it came a stable monetary supply and inflation rate. The gold-backed paper money improved on minted coins by providing easier transportation of money and improved on the arbitrage risk of bimetallist exchange rates.

Problems with the Gold-Backed Paper Notes

The gold standard introduced the element of “trust” into currency. Since the gold stockpiles were not publicly accessible, owners of gold-backed paper money had to trust that the government was backing their monetary supply. As history has shown, trusting the government never goes well. In 1934, the price of gold was set from about $20 to $35 per ounce by orders of the United States government. This increased the monetary supply by about 70% overnight, leading to a significant jump in inflation. Furthermore, the storage of gold is an expensive and dangerous task. Fort Knox, for example, is said to house the gold reserves of the United States. Fort Knox is guarded like a fortress, costing the American taxpayer millions of dollars per year just to protect the monetary supply. Gold-backed paper notes failed as a currency, not only because they were an expensive storage of value, but because it fell victim to centralized control by the US government.

Bretton Woods System

Now we reach out current monetary system, known as the Bretton Woods System. In 1944, the United States dollar was made the reserve currency of the world, replacing the gold standard that preceded it. The government did not want to limit the monetary supply to its reserves in gold, they wanted to make more money to spur the economy and pay off debts. This also gives the United States the power to cut off any party from using the world reserve currency, excluding them from the economy. This can be useful in the event of sanctioning a foreign aggressor but can also lead to an overstep of power by a central authority.

Problems with the Bretton Woods System

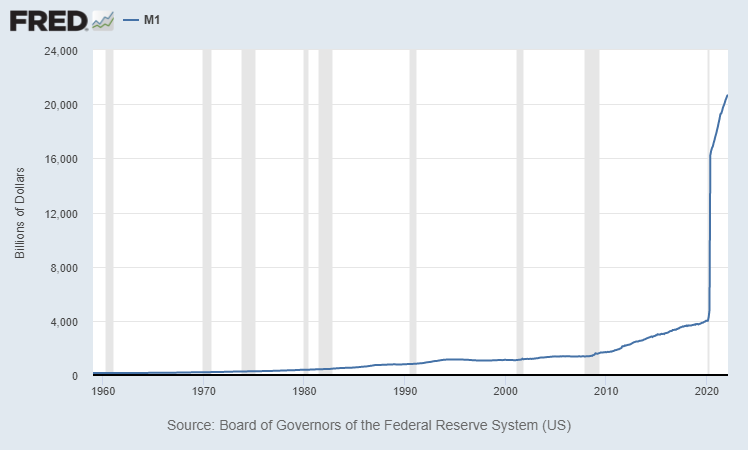

The value of a dollar is backed only by the faith that the United States will continue to agree a piece of paper is worth a dollar. With no limits on monetary supply, the M1 money supply has increased more than 150x in 60 years (see graph below). With this has come tremendous inflation. With no value behind the dollar, each dollar printed debases the currency, leading to rising prices. The 2020-2022 section of this graph illustrates this point brilliantly, showing that about 80% of all money created during this Bretton Woods system was created in the last two years.

Hyperinflation in the fiat currency era has destroyed nations. Venezuela, Turkey, and Weimar Germany have all seen economic collapse due to irresponsible monetary policy, leaving their citizens impoverished and starving in the streets. The Bretton Woods Fiat system failed because it left the control of money in the government’s hands. History shows us that doing so can have fatal consequences.

Summary of the Shortcoming of Past Monetary Systems

The bartering system was abandoned because the “money,” being resources and objects, was not an efficient means of exchange, nor storage of value. Livestock die, crops rot, and it became harder and harder to find bartering match-ups.

The minted coin system improved on the barter system by creating a more efficient means of exchange and storage of value. Coins do not rot or die and are easier to carry than wheat or a cow. However, price arbitrage largely led to this system being abandoned due to its inefficiency as a storage of value.

The Gold Standard, being paper notes backed by gold, sought to improve the arbitrage issue of metal coins by backing up each dollar with gold stored by the issuing authority. However, the central authorities themselves engaged in arbitrage and price manipulation, leading in part to the failure of this monetary system, due to the lack of trustworthiness of the “third party,” along with the inefficiency of protecting physical gold storages.

Finally, the current monetary system known as the Fiat System, in which paper money is printed with nothing to back its underlying value, was created to increase the monetary supply to encourage economic growth, and aide in paying off national debt. This system has largely failed due to corrupt and irresponsible monetary supply, leading to inflation that, when accelerating at a fast enough rate to significantly outpace increases in wages, causes the collapse of a society into chaos and poverty. The Fiat system failed for a similar reason as the Gold Standard – the central authority was not trustworthy.

Introducing Bitcoin

In the early 2000’s, a group of cryptographers (people who use codes and ciphers to protect information), realized that they could make a better monetary system. Following the 2008 recession, which is seen by many as the failure of the fiat monetary system, an anonymous person or group known as Satoshi Nakamoto published the Bitcoin whitepaper, describing the invention of a modern technology called a blockchain, for use as a means of payment and storage of value.

A blockchain is composed of a network, or group of computers, which can be located anywhere in the world. These computers all record the movements of the blockchain’s token, being Bitcoin. Every time a Bitcoin is sent or received, each computer records that transaction in an extensive list, or ledger. These transactions are public, and viewable by all. See the Bitcoin ledger here.

How Does Bitcoin Address the Problems?

Bitcoin addresses each of the reasons the previous four monetary systems failed.

First, Bitcoin is an efficient means of exchange. To exchange Bitcoin, a user simply scans a QR code with the receiver’s address (account) and clicks send. The network of computers records this transaction and moves the Bitcoin to the receiver’s account. No paper bills, no gold coins, and certainly no cows or bales of hay are needed, only a smartphone and an internet connection.

Second, Bitcoin is becoming a better and better storage of value. Bitcoin is simply a series of code, and so long as the network stays live, a user will be sure their Bitcoin is in their account. Bitcoin is hack proof, meaning no one can steal a user’s money, so long as the user keeps their account passphrase a secret. Bitcoin also has a fixed supply, at twenty-one million coins. This means that Bitcoin will not have its value debased by hyperinflation as many Fiat currencies have. While an argument against Bitcoin as a stable storage of value is its incredible price volatility, the growth of the Bitcoin network decreases this risk each day. Any asset with a small market cap is subject to larger volatility, as it takes less capital to move the market. While Bitcoin might have lost half of its value in a few short hours several times in the last few years, it is commonly understood that as Bitcoin adoption grows and market cap increases, volatility will decrease. The market cap of Bitcoin today is $837 billion dollars - if Bitcoin reached an $8 trillion dollar market cap (10x increase), it would take 10 times as much capital to move the market. With adoption, this concern becomes less and less important.

Finally, Bitcoin removes the need for trust in the central authority that issues a currency. Bitcoin needs no government approval or permission for one to use it. No government can change the code of Bitcoin to create more, nor can they manipulate the price. Bitcoin is known as a “trustless” system, meaning there is no need to trust any other party while transacting in Bitcoin, because the code is foolproof.

Case Studies

Fleeing Afghans use Bitcoin to Protect Wealth from the Taliban

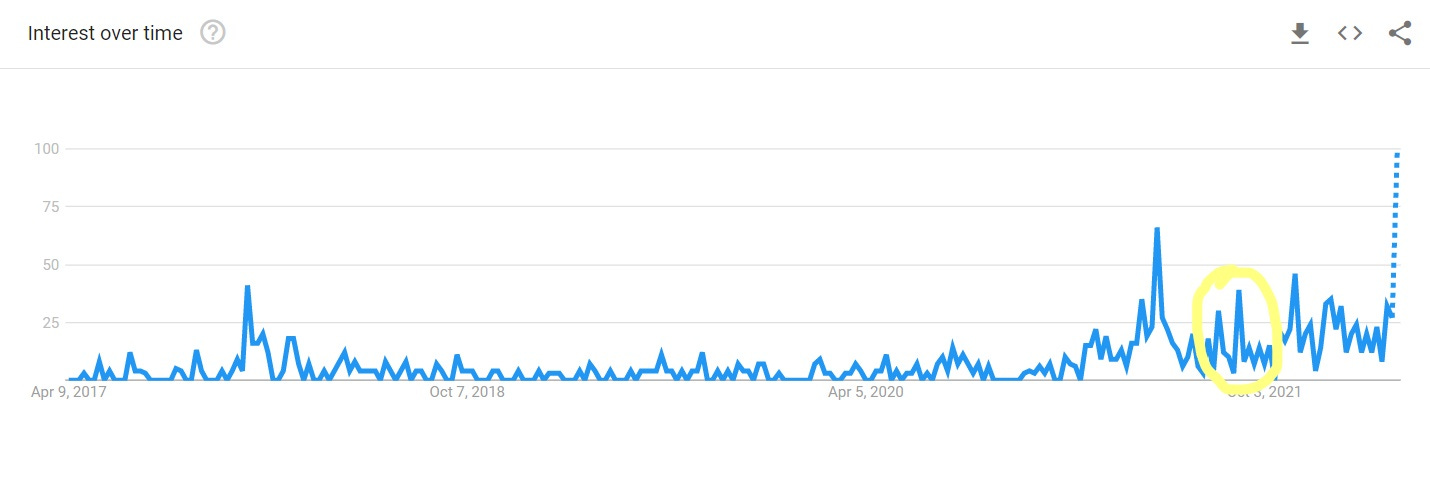

The first case study shows Bitcoin’s use case as a form of money that is easy to transport, and resistant to centralized authority seizure. Bales of hay, gold coins, and even large stacks of bills are all difficult to move and can be confiscated or stolen. When the Taliban regained control of Afghanistan in September of 2021, many Afghans fled, fearing the reign of terror that was coming. The banks were closed, and the Taliban set up checkpoints around the country, stealing any valuable items a soon to be refugee might have. Any gold coins, or paper money were taken. Bitcoin, however, served as a safe-haven asset for those wise enough to use it. Individuals who transferred their wealth to Bitcoin were able to flee the country, their life savings safely protected on their Bitcoin wallets. Bitcoin provides the most secure and most transportable storage of value of any asset on the planet. Below shows the Google Trends Interest graph of cryptocurrency in Kabul. Highlighted in yellow is a peak of interest just as the Taliban took over.

Bitcoin on Avoiding Foreign Economic Attacks

The second case study shows Bitcoin’s immunity to manipulation and control by a central authority through its utility as a means of avoiding foreign economic attacks. Fiat currency, or its payment railways (think SWIFT banking system), are controlled by the centralized authorities that create the money being used. The United States government, the creator of the world reserve currency, can decide who is allowed to use their money and payment railways.

Recently, the United States imposed economic sanctions on Russia, barring them from using US dollars to transact with the global economy. While in this case, it is agreed by Western nations that these sanctions were necessary and good, it is important to remember that the United States could be sanctioned by a foreign country at some time in the future. What then?

To avoid being shut off from the ability to access and transact with one’s money, Russia, or any country in its position, could use the Bitcoin blockchain to keep their economy alive. While the United States might control the payment railways that use US dollars, no one controls the payment railways of the blockchain. Russia is theoretically able to purchase oil, food, supplies, etc. using Bitcoin, skirting the sanctions placed on it by the United States.

Bitcoin’s use case as a trustless and decentralized monetary system is proven through the Russian sanction example.

Want to hear more from us? Be sure to subscribe to Venture Time to see weekly posts on subjects ranging from Angel Investing and Entrepreneurship, to Macroeconomics and Cryptocurrency.

Very thorough and well-thought out reflection on Bitcoin as a whole. This is a great introductory read for anyone interested in Bitcoin.