The first time I heard about Bitcoin, I was showing my father my Minecraft world. I told him that I mined 3 diamonds and was going to make a diamond axe. My dad laughed, and said to me:

“James, you should stop mining diamonds, and start mining Bitcoin.”

What is Bitcoin Mining?

In the beginning, there were 21 million Bitcoin in existence, but none were available. For a Bitcoin to be “issued,” a person uses their computer to solve a complex math problem, rewarding them in some amount of Bitcoin. The idea here was to turn the energy the computer consumed to solve the math problem into money. This is referred to as mining Bitcoin.

Just as I might solve a math problem faster than a friend of mine, some computers solve these math problems faster than others. Every computer has a specific “hash rate,” or measure of computational power. The more hash a computer has, the faster it can mine Bitcoin.

When a math problem is successfully solved, the miner will be rewarded with a certain amount of Bitcoin, called the reward. The reward amount varies, based on the “halving cycles.” In 2009, the reward for one of these problems was 50 Bitcoins. Every 4 years (roughly), this reward is split in half. In 2012, the reward became 25 Bitcoins, in 2016 it became 12.5, and so forth. This controls the rate at which Bitcoin can be created.

If I can use my laptop to mine Bitcoin, then why isn’t everyone?

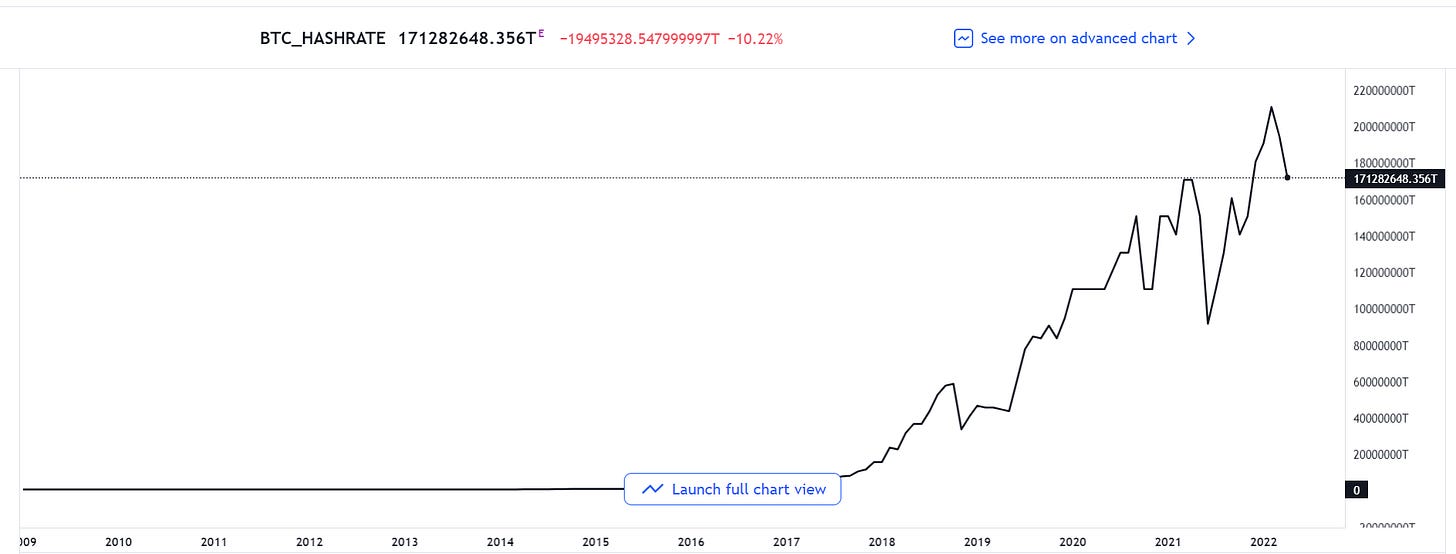

With only 21 million Bitcoin to ever exist, the Bitcoin mining industry is the world’s greatest race. The total amount of computing power directed towards mining Bitcoin at any given time is called the “network hash rate.” The higher the hash rate, the more competitive the race for remaining Bitcoins. On January 1st, 2015, the network hash rate of Bitcoin was .34 exahashes per second (EH/s), with one exahash being equivalent to one quintillion hashes. Today, the hash rate is 188.02 EH/s. In 2015, very few people were mining Bitcoin, and those who did were rewarded handsomely. Today, there is more than 500 times the competition for each Bitcoin remaining.

To beat out the competition, people bought better and better computers, and mined in more efficient ways. In 2009, you could have mined Bitcoin using your laptop, since the hash it could produce would have been competitive against the very small .34 EH/s network hash rate. This type of mining was called CPU mining. Very quickly, however, people saw that using a computer built to play games, watch TV, or do work was not the most efficient way to mine Bitcoin.

Next came GPU mining. GPU mining is like CPU mining, but in this case, the graphics card of a computer was used to solve the math problems. Graphics cards are made to handle immense computing power, as video games have a lot of information being relayed and displayed at any given time. GPU mining allowed people to ditch the non-Bitcoin related parts of a computer and buy only the graphics cards to mine Bitcoin.

Today, the top-of-the-line Bitcoin miners are the ASIC Antminer S-19s. ASIC stands for “application specific integrated circuit,” a computer made for a single purpose – Bitcoin mining. These machines use a special chip that is designed purely for Bitcoin mining, not to run a laptop or play video games. An ASIC Antminer S-19 produces 110 terahashes per second (TH/s), with one terahash being equivalent to one trillion hashes. For reference, CPU miners produced about 1300 H/s, which is equal to .0000000013 TH/s.

Since it takes an exponentially larger amount of computing power to be competitive in Bitcoin mining, how can it still be profitable if the block reward is cut in half every four years?

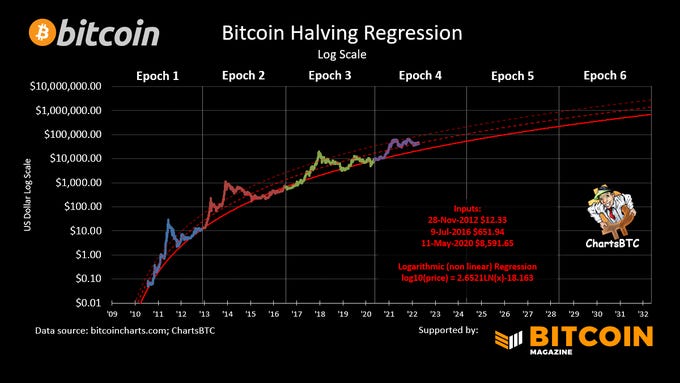

The answer to this lies in basic supply and demand. During one cycle of four years, the inflation rate, or the supply of new Bitcoin entering the market, is fixed. Let’s use the second halving as an example. In 2015, the block reward for mining Bitcoin was 25 coins. The market became accustomed to this amount of new supply entering the market, and the price moved to the point at which all buyers were accommodated. In 2016, when the reward was halved, a supply shock ensued. Now, there were half as many Bitcoins being mined and entering the market as before. A steady demand and a decreasing supply led to a rise in price. The chart below shows an interesting pattern that supports this statement. About 2 years after a halving, the price rises dramatically, before remaining relatively steady for the remainder of the cycle. While the block reward was cut in half, miners were being rewarded in 12.5 Bitcoins that were worth 10 times as much as they were in 2015. While the number of coins being rewarded dropped, miners made much more money after the halving.

Profitability Variables

In 2022, there are billions and billions of dollars entering the Bitcoin mining industry, as entrepreneurs hope to grab a piece of the remaining supply. A final consideration on Bitcoin mining is the geographical locations in which it is done.

The requirements for a location to be a profitable Bitcoin mining location depends on the following factors: energy costs, climate, and internet speed.

Bitcoin is exchanging energy for digital currency. A miner wants to make sure that the energy they are spending is less than the currency they receive. In Durham, New Hampshire, energy costs about 18 cents/Kilowatt hour. In Quebec, Canada, the cost is 7 cents/Kilowatt hour. The exchange rate between energy and Bitcoin is clearly more advantageous in Quebec, or any location with a lower cost of energy.

Bitcoin miners, like all computers, can overheat. These miners are built to withstand running 24/7/365, but the heat they generate can have an impact on their efficiency. Miners have adapted to this issue by circulating air inside a mining facility with large fans or airplane engines, but these cost money. Instead, miners look for cold regions to place their miners, so that the computers do not overheat.

Finally, the internet speed is important when mining Bitcoin. Without internet connection, the software cannot run.

Locations that meet these requirements include Canada, Iceland, Kazakhstan, and Wyoming.

The Bitcoin mining industry is a complex whirl of math and energy cost calculations, but it can be boiled down very simply. Bitcoin mining exchanges energy for digital currency, and releases new supply of Bitcoin into the market. While Bitcoin mining continues to be a very interesting and complex practice, miners have been rewarded with one of the most profitable industries of the 21st century.

Want to hear more from us? Be sure to subscribe to Venture Time to see weekly posts on subjects ranging from investing and entrepreneurship to macroeconomics and cryptocurrency.