How Cryptocurrency Works

In light of Bitcoin (BTC) recently reaching a new all-time high, more people than ever before are entering the cryptocurrency market. It is estimated that over 35 million people in 10 countries own cryptocurrency, with there being over 4,000 cryptocurrencies in existence. Currently, there are about $160.4 billion of Bitcoins alone in circulation.

Needless to say, Bitcoin and other cryptocurrencies have created massive wealth for some. If one had bought a single Bitcoin at its inception in 2010, when a Bitcoin was $0.08, they would have made a 718,125x return by selling it at its recent height. To put this into perspective, five dollars worth of Bitcoin in 2010 would be worth almost $3.6 million today. While the opportunity to get in on such a low price may never arise again, Bitcoin has still appreciated significantly in recent history. In 2020, Bitcoin had a 323% year-over-year increase and a 507% rise since its drop in March of 2020. While Bitcoin has been an extremely volatile asset across its lifetime, with newer cryptocurrencies proving even more unpredictable, its long-term returns cannot be discounted.

In pursuit of understanding this relatively new asset class, this article will explore the purpose of cryptocurrency, the underlying system that makes cryptocurrency possible, and what drives the value of cryptocurrency.

What is Cryptocurrency?

Cryptocurrency is an encrypted string of data that is encoded to signify a unit of currency. It has no real physical form and is not backed by a physical commodity like gold. The cryptocurrency economy works on a peer-to-peer (P2P) basis, meaning that the currency is decentralized (not controlled by any central authority) and that its market dynamics are dictated primarily by the activities of those who own and transact the currency (not by monetary policy, for example). Cryptocurrency transfers can be completed with minimal transaction fees, allowing users to avoid the far larger transaction fees charged by traditional financial institutions.

Major cryptocurrencies use three fundamental pieces of information:

The Address: This is associated with an account balance and is used for sending and receiving currency. The address has its own corresponding public and private keys. If cryptocurrency worked like a traditional bank account, think of the address as the account itself.

The Private Key: This is what grants a cryptocurrency user ownership of the currency on a given address. Private keys are automatically generated and stored by the blockchain wallet (software used to access the P2P cryptocurrency economy). When one makes a transaction, the blockchain wallet’s software signs the transaction with that user’s private key (without actually disclosing it), signifying to the entire network that this user has the authority to transfer currency on the address used. Following our analogy, think of the private key as the username, password, and credentials for the account itself, as well as the software that allows the account to send and receive funds.

The Public Key: Unlike the private key, one’s public key can be obtained and used by anyone to encrypt messages and transactions intended for a particular recipient. These messages and transactions can only be decrypted (and thus, delivered) by the receiving user’s private key. In our analogy, the public key would be a check or another mechanism that allows others to complete a transaction with a user without knowing that user’s private account information (the private key).

How Cryptocurrency Works

Prior to Bitcoin’s creation, several companies had tried and failed to create digital cash systems, and it was widely accepted to be an impossible feat. All prior attempts to create a digital cash system were centralized (controlled by a central entity), and couldn’t solve the problem of double spending: a type of deceit in which the same money is promised to two parties, but only delivered to one. The anonymous creator(s) of Bitcoin, known only as Satoshi Nakamoto, was the first to successfully create a digital cash system that was free of double spending risk. Instead of being run by a central server that keeps records of all the transactions taking place, Bitcoin and the cryptocurrencies that followed it were run on a decentralized P2P system. This means that every computer on the network does the job of recording and validating transactions. The issue that arises with a decentralized system such as this is that all of these computers would have to agree that a transaction is valid for it to proceed; if even one entity were to disagree about the validity of a transaction, the whole system would become dysfunctional. Achieving this absolute consensus was the barrier to creating a decentralized system that no one could surpass until Satoshi Nakamoto figured it out, and in doing so, created the first blockchain technology.

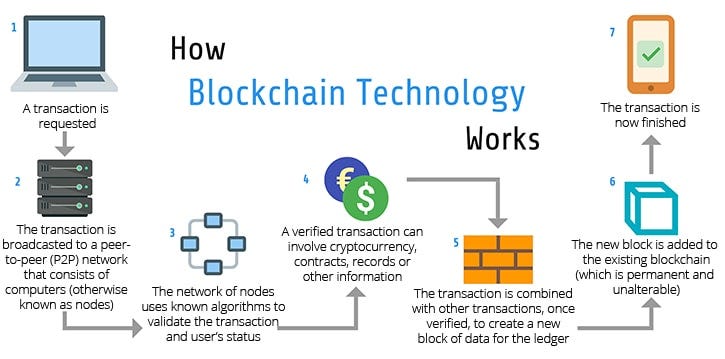

Here is how a transaction is accomplished with this blockchain technology:

The transaction is a file that says: “Person A gives X Bitcoin to Person B.” This file, once sent, is signed by Person A’s private key.

This transaction is then broadcasted to the network for validation from every other peer (computer) on it.

After a specific amount of time, the transaction gets confirmed. This transaction is combined with several other transactions into a “block” that is added to the P2P’s permanent records (stored on every computer in the network), called the blockchain. Because this record becomes permanent, a transaction cannot be altered or canceled once confirmed by the network. This is part of what makes blockchain technology so secure; hackers cannot edit or cancel transactions and it is yet more impossible to decode someone’s private key to steal ownership of their address.

Figure 2 provides a visual representation of how blockchain technology facilitates cryptocurrency exchanges:

So what role do cryptocurrency “miners” play in this process?

Well, it is only miners that can confirm transactions. This is their job in a cryptocurrency network. They take transactions, confirm them as legitimate, and spread them in the network. After a transaction is confirmed by a miner, every node of the network has to add it to its database for it to become part of the blockchain. Both the validation of a transaction and the sending of the confirmed transaction to every other node in the network takes a sizable amount of computer processing power to complete. In exchange for a miner providing their computer’s processing power to the P2P network, they are rewarded with novel cryptocurrency by the system. This is how cryptocurrency is “mined.” Mining is how new cryptocurrency is generated and added to the total outstanding supply. It is through this system that independent actors are economically incentivized to maintain the legitimacy of the system and its transaction history.

The Purpose of Cryptocurrency

Today, cryptocurrency is used for a number of purposes, but its originally intended purpose was not for use as a currency. When Satoshi Nakamoto anonymously announced the first release of Bitcoin, its stated purpose was as a decentralized “new electronic cash system that uses a peer-to-peer network to prevent double-spending.”

Perhaps one of the first uses that cryptocurrency was quickly adopted for was its use on the black market. The Silk Road, a notorious dark-web black market primarily used for buying and selling drugs, was one of the first large platforms to accept Bitcoin. Because cryptocurrency is secure and anonymous, this made it perfect for use in illicit activities. Unfortunately, cryptocurrency’s reputation was tainted for a long time due to its predominant use in black markets.

Cryptocurrencies are also used by many because they protect against the risks associated with monetary policy implemented by central banks, including inflation. Most cryptocurrencies contain code that fundamentally limits their supply to a specific cap. For example, Bitcoin has a total supply of 21 million units (not all of which have been “mined” — these “unmined” Bitcoins are not yet outstanding). This gives Bitcoin a built-in anti-inflationary mechanism.

Lastly, cryptocurrency is also used for investment purposes. This is because, as will be explored shortly, cryptocurrency has the potential to increase significantly in price over time, as Bitcoin, Ethereum, and many other cryptocurrencies have proven.

Value Drivers of Cryptocurrency

Supply and demand are perhaps the most significant drivers of value in cryptocurrencies.

Demand fluctuates based on several factors such as the usability and visibility of the currency and voting rights users are allowed (any changes to a cryptocurrency requires consensus from users, who vote on whether to enact a given change; cryptocurrencies with restrictive voting rights may not be attractive to those who want control and cryptocurrencies that allow for quick and efficient decision making are often favored for their ability to adapt to changing conditions). Demand for a cryptocurrency is also influenced by available competition. Currently, initial coin offerings (ICOs) occur frequently due to low barriers to entry, but should these barriers to entry become higher, demand for existing currencies would increase.

Cryptocurrency supply is impacted by the rate at which new currency is created through mining. Many cryptocurrencies are designed to slow in supply growth over time, creating scenarios in which demand grows faster than supply, driving up price. Supply is also impacted by the number of cryptocurrency units allowed to exist by the given system. Once the maximum limit is reached, the role of supply in determining the currency’s price is minimized.

Cost of production is, surprisingly to many, a significant factor driving cryptocurrency prices. While cryptocurrencies have no physical form, they do incur a real cost of production, with electricity being the main expense incurred. Research has shown that Bitcoin’s market price is closely linked to its marginal cost of production.

Availability on currency exchanges is also an important cryptocurrency price driver. As cryptocurrencies are frequently traded on exchanges such as Coinbase and GDAX, the popularity and policies of these exchanges significantly impact the prices of cryptocurrencies trading on them.

Regulations and legality conditions pose threats and opportunities for cryptocurrencies that can influence price. Cryptocurrency currently operates in a legal grey zone as the Securities and Exchange Commission (SEC) classifies cryptocurrency as securities, while the U.S. Commodity Futures Trading Commission (CFTC) considers cryptocurrency a commodity. This confusion over which regulator will set the rules for cryptocurrency creates uncertainty. Additionally, financial products such as exchange-traded funds (ETFs) and futures have emerged that use cryptocurrency as their underlying asset. This affects price in that it allows access to investors who cannot afford the more expensive cryptocurrencies like Bitcoin, but still believe in the asset’s potential to appreciate over time. The emergence of these new financial products can also reduce price volatility, as they allow institutional investors who believe cryptocurrency futures are overpriced or underpriced to place bets that the price will move in the opposite direction.

Forks are changes in the governing rules of a cryptocurrency’s software that require consensus. Soft forks are those that do not catalyze the creation of a new cryptocurrency, while hard forks result in entirely new cryptocurrencies (bitcoin cash and bitcoin gold were the results of hard forks). New cryptocurrencies or unfavorable changes in governing rules can drive users away from a given cryptocurrency and thus decrease demand, driving prices down. Conversely, should soft forks make using a cryptocurrency more favorable, demand could be driven up.

This article is a must read by anyone concerned with the monetary marketplace. Well written- very informative! A springboard for more information.