The Technology Fallacy

Why the narrative is broken and how you should reframe your mind

"Malo periculosam, libertatem quam quietam servitutem." - Thomas Jefferson

“What do you want out of life?”

Chances are you’re looking at the above question in confusion. It is a very broad question; you could take your interpretation in multiple directions.

How about I reframe it for you?

How about: “Who do you want to dictate what you want out of life?”

When framed in this way, your answer probably changes dramatically. Maybe its your parents, your government, or yourself.

Regardless, I target this piece as a wake-up call for all the dreamers, techno-utopians, luddites, atheists, the religious, people who keep up with the Kardashians, and more.

Over the last decade, we have seen the phenomenal rise of phone usage with Americans now spending nearly a month and a half (44 days) on their phones throughout the year. I’m not here to tell you to stop using your phones. The importance of a phone has become crucial for anybody navigating the 21st century. What I am here to tell you is that your smartphone data is a component of the larger AI picture which improves algorithms and in theory, should result in a more user friendly experience for the consumer of the smartphone.

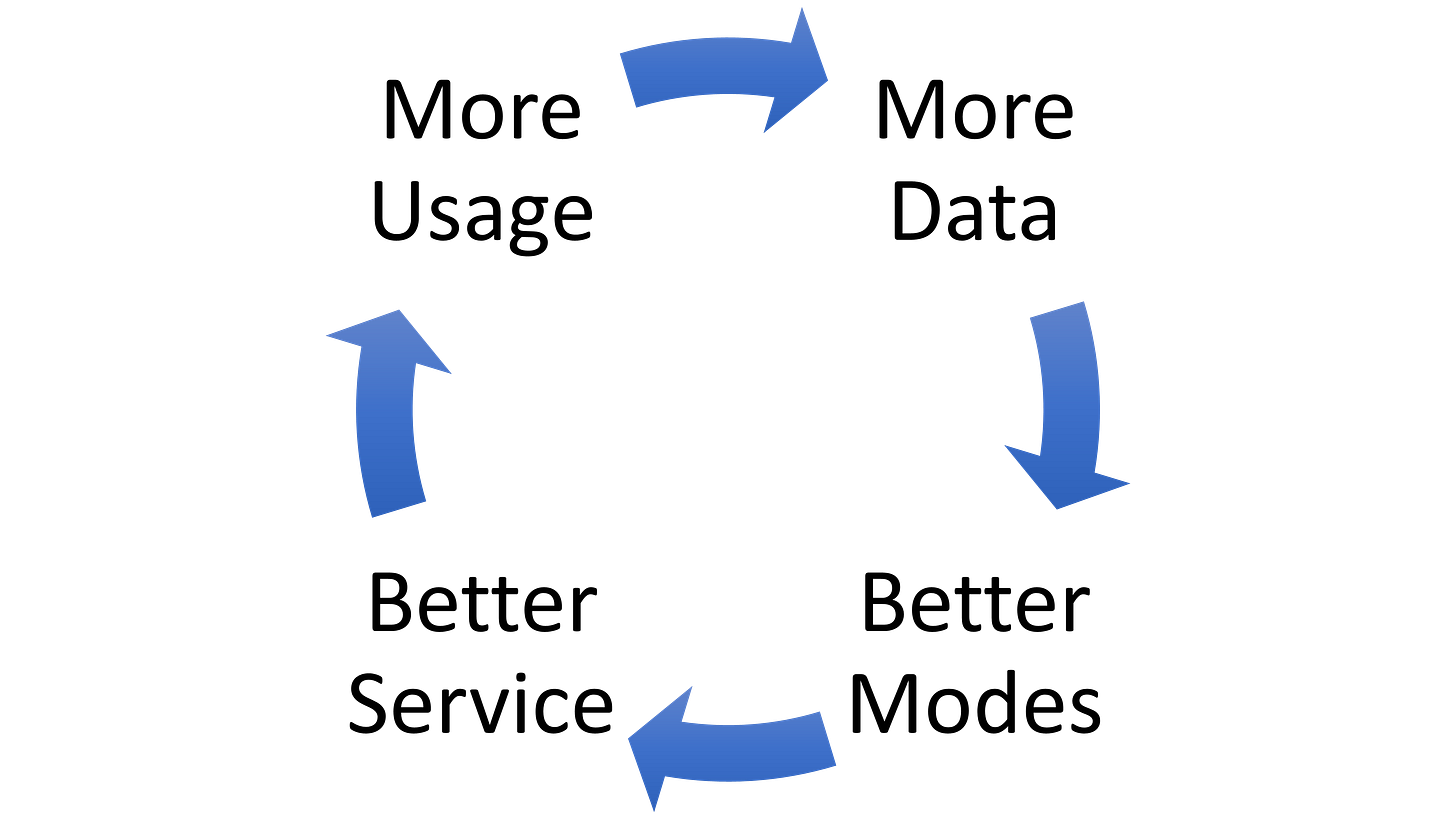

When you break it down, it looks like a beautiful never-ending cycle of continuous improvement - very Kaizen.

However, the gathering of data is also a double-edged sword driving the ethical debate of invasion of privacy versus guarantees of safety. This leads me to my focal point. With better technology comes less freedom, whether we like it or not, and we have already sacrificed more freedom than we realize in the pursuit of maximized utility.

Before you call me a hypocrite for clicking “yes” on allowing cookies, trust me, I’m in the same boat. I agree to give up a certain amount of my freedom (personal information) in exchange for better technology. Developments in blockchain allow for anonymity across transactions, but most people operate their blockchain wallets using an ‘established’ (i.e. backed by PE and VC from developed markets) trading application like Coinbase, Robinhood, or even Venmo.

But the thing about these ‘established’ trading firms is that they follow the tradeoff above by continuing to track and use data the same way traditional tech companies do. In doing so, they continue to grow this fallacy of technological growth as a democratizing tool. Just take a look at Ben Hunt’s article: “In Praise of Bitcoin.”

In my dystopian vision, Bitcoin isn’t banned or criminalized. Pfft. That’s a rookie, weak State move. No, I see a future where everyone buys Bitcoin. Where you are encouraged to buy Bitcoin. Where Bitcoin is sold to you morning, noon and night. Where normie economists get on conference calls late at night because they’re Bitcoin price-curious.

Except it’s not really Bitcoin.

Instead, it’s Bitcoin! TM — a cartoon version of the OG Bitcoin, either a Wall Street-abstracted representation of the price of Bitcoin or a government-painted version of Bitcoin in Dayglo orange. Either way — abstracted or painted — your Bitcoin! TM is trackable and traceable, fully KYC and AML and FBAR and SWIFT and every other US Treasury acronym-compliant. Either way, your Bitcoin! TM has all the revolutionary potential of a bumper sticker and all the identity signaling power of a small tattoo on your upper arm.

Bitcoin! TM doesn’t stick it to the Man … Bitcoin! TM IS the Man.

It has been fascinating witnessing the rapid developments of digital currency over these last couple of years, including the bombardment of Mark Wahlberg and Lebron James Crypto.com ads coming across the TV screen.

Bitcoin rapidly rose in correlation with the S&P500 over the month of January:

Nearly a third of Bitcoin’s value is held in the top 0.01% of accounts:

And just as how gold was commoditized by Wall Street through ETFs promising ‘casino chips’ for the price of gold, we see history rhyming once again.

So if we live by the expectations of Moore’s Law where the number of transistors in a dense integrated circuit doubles about every two years, then we should also expect the rate at which technology encroaches on our freedom to follow this same pattern.

Of course, ‘freedom’ has such a subjective interpretation and we often do not realize the boundaries that it entails. So while I’m not counting down as pessimistically as the annual doomsday clock, I’m not expecting the utopian society from Brave New World either.

What we can point to as something increasing at an accelerating rate just like Moore’s Law is the amount of fiscal spending occurring over this upcoming decade as presented by the Clocktower Group.

Throughout the past several centuries, the human race has dominated its reach for natural resources through geographic expansion buoyed by industrial revolutions throughout history. However, these new green investments will stress their focus on efficiency, representing a shift that focuses more on customized production and critical resources while maintaining the image of a ‘net-zero’ product in-hand. And to further add fire, these investments are largely being conducted with the backdrop of an increasingly polarized world where political parties across the spectrum call for deglobalization through improvements in domestic supply chains.

Bringing this all together, once you begin to see the importance and ‘need’ of such improvements in technology as pushed by those in power, then you begin to see the direction in relation to the double-edged sword. Ultimately it will come down to who, what, and how people treat those that control the technology, just as it always has been from the wheel to the machine learning algorithms we deploy.

“But it was alright, everything was alright, the struggle was finished. He had won the victory over himself. He loved Big Brother.” - George Orwell

So where will technology bring us? And does the future really need us?